Sodexo Q1 Fiscal 2023: strong start to the year

- Revenue growth +20.2%

- Organic revenue growth +12.3%

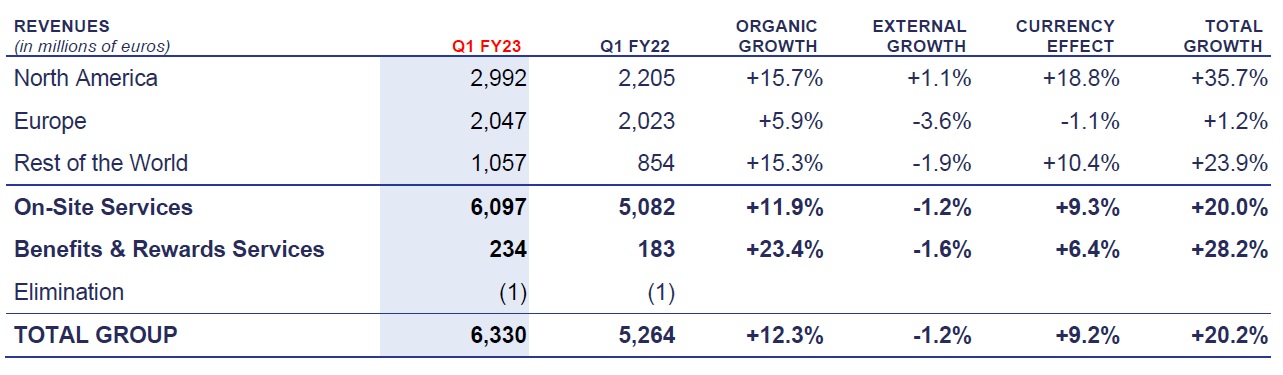

Q1 Fiscal 2023 revenues

Commenting on the First quarter 2023 performance, Sophie Bellon, Chairwoman of the Board and CEO said:

“As expected, we have had a strong start to the year.

On-Site Services continued to benefit from the post-Covid ramp-up, with a higher level of attendance, in all geographies, in the workplace, in stadiums, in convention centers and in Universities. Price increases also boosted revenue growth. As a result, On-site Services activity is back up over First quarter Fiscal 2019 levels.

Benefits & Rewards Services organic growth continued to accelerate, reflecting in particular this quarter, higher interest rates in the euro zone and a large one-off Klimabonus contract in Austria.

During the quarter, we also delivered positive net development and strong cross-selling.

We are on track.”

Highlights of the period

- First quarter Fiscal 2023 consolidated revenues reached 6.3 billion euros, up +20.2% year-on-year including a net effect from acquisitions and disposals of -1.2%, and a strong positive currency impact of +9.2%, reflecting the strength of the US dollar and the Brazilian real. Organic growth remained strong at +12.3%.

- On-site Services revenues reached 6.1 billion euros, up +11.9% organically. This growth reflected the recovery in Food services, up +19.2%. Facilities Management Services organic growth impacted by the end of the Testing Centers contract in the UK stalled at +0.5%. Excluding this, Facilities Management Services was up by nearly +6%. Higher prices contributed about 5-6% to growth. By zone, the key elements were:

- North America generated organic growth of +15.7% boosted by the post-Covid return to the workplace, a better-than-expected increase in the sporting and convention center activity and more retail and event catering activity on University campuses. Healthcare was also up in particular due to a strong increase in retail sales.

- In Europe, organic growth was more contained at +5.9% due to the end of the Testing Centers. However, there was a strong return to the workplace across the zone as well as a recovery in the number of corporate events and tourists, particularly in Paris.

- The Rest of the World organic growth was +15.3% with a very solid performance in Business & Administrations in all regions despite the impact of the sporadic lockdowns in China and a particularly strong recovery in Education in India.

- The acceleration of the organic growth in revenues of Benefits & Rewards Services continued in the First quarter, at +23.4%. Higher demand, face values, net new business and interest rates all contributed. In particular, the quarter benefited from higher interest rates in the euro zone for the first time and a significant one-off contribution from the Austrian Klimabonus.

- During this first quarter, Sodexo continued to reinforce its commitments to reduce its environmental footprint:

- Sodexo progressed towards its 2025 CSR objectives:

- By promoting plant-based meal options: Sodexo just concluded its first global Sustainable Chef Challenge. This international competition brought together Sodexo’s talent to showcase innovative dishes.

- By raising awareness about the importance of reducing Food waste: Sodexo has celebrated the 10th Anniversary of its WasteLESS Week Campaign.

- Our Corporate Responsibility achievements have also been recognized externally:

- For the 18th consecutive year, Sodexo was ranked as one of the top-rated companies of its sector in the Dow Jones Sustainability Index (DJSI).

- Sodexo earned top LGBTIQ+ inclusion achievement from 2022 Workplace Pride Global Benchmark.

- Sodexo has been awarded the 2022 GEEIS-SDG trophy for its gender equality initiative “Fairy Godmother” in Brazil.

- Sodexo received the 2022 AGEFI Sustainable Business Award in the Environment category.

- Sodexo progressed towards its 2025 CSR objectives:

Outlook

The strong start to Fiscal 2023 in the first quarter was expected. As we progress during the year, the post-Covid ramp-up will reduce gradually. From the second quarter, the strong momentum in Benefits & Rewards Services will continue but against a stronger comparative base. Growth is expected to be higher in the first half than in the second half of the year, even if the progressive increase in the contribution of last year’s net new development will support the organic growth in the second half.

Group Fiscal 2023 guidance is maintained:

- Fiscal 2023 organic revenue growth expected to be between +8 and +10% driven by:

- Further recovery in Corporate Services and Sports & Leisure;

- Positive net new business momentum including expected further improvement in retention;

- Inflationary pricing at 4-5%;

- Partially offset by the impact of the end of the Testing Centers contract in the United Kingdom (-100 bps).

- Fiscal 2023 Underlying operating profit margin close to 5.5%, at constant rates, supported by:

- Continued price increases and inflation mitigation action plans;

- Operational excellence including supply chain efficiencies;

- Further ramp-up in volume;

- Increased investment to sustain growth.

Fiscal 2023 guidance for Benefits & Rewards Services is also maintained:

- Organic growth of +12 to +15% for Fiscal 2023, driven by:

- Further progress in new business, cross-selling and retention;

- Strong demand in all regions;

- Benefits from inflation and higher interest rates.

- Underlying operating profit margin around 30% at constant rates for Fiscal 2023, supported by:

- The benefits of the topline growth flow-through;

- Increased investment in technology, digital offers, brand and sales & marketing.

To read the full version of the press release, please download the PDF:

- Press release (PDF)

- Presentation (PDF)